Payroll software like Talenox are LHDN-approved and available for companies to ensure the accuracy of their PCB calculation. The participating banks are as follows.

Malaysian Tax Issues For Expats Activpayroll

Check it out for yourself in a 30-day free trial with Talenox.

. Individual Income Tax Return Frequently Asked Questions for more information. Income Tax CP22 is a form that has to be submitted by the employer to notify LHDN on the newly recruited employees where else income tax form CP22A is a form that is submitted by the employer to notify LHDN on any employees in the cease of employment in forms of retirement or leave Malaysia permanently. Such deductions are limited to 5 of the total gross.

First of all you need an Internet banking account with the FPX participating bank. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR and tax year 2021 or later Forms 1040-NR. Both CP22 CP22A have to be submitted.

Some examples of documents where stamp duties are applicable include your Tenancy Agreement Instrument of Transfer and Loan Agreements. Likewise if you need to estimate your yearly income tax for 2022 ie. Here are the many ways you can pay for your personal income tax in Malaysia.

1 Pay income tax via FPX Services. Assessment year 2023 just do the same as previous step with your estimated 2022 total income but choose 2022 for PCB year. SQL Payroll Software removes the complexities in Human Resources Management make your payroll process easier.

The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. Taxpayers can start submitting their income tax return forms through the e-Filing system starting from March 1 of every year unless otherwise announced by LHDN. The income of a listed IHC is treated as business income and expenses are given full tax deduction.

You can file Form 1040-X Amended US. This method of e-filing is becoming popular among taxpayers for its simplicity and user-friendliness. SQL Payroll is the only software that you would ever need to use for your Payroll.

Employers Responsibility The employer is obligated to inform the assessment branch of IRBM by filing and submitting a CP 22 form. New York City has an additional 150pack tax on cigarettes making it one of the most expensive cities to buy a pack in the United States. Remember that R is the percentage of tax rate which is a fixed 15 for a KWASR.

Your filings for tax relief from life insurance premiums will be subject to approval from the Inland Revenue Board of Malaysia LHDN so remember. The tax on cigarettes and little cigars are 435 per pack of 20 cigarettes and other tobacco products are taxed at 75 of their wholesale price. An unlisted IHC may claim deductions for a certain proportion of administrative expenses such as staff wages and management fees.

Snuff is taxed at a rate of 2 per ounce. Form CP22 is a report from the government issued by the LHDN and also a form for New Employee Notification. See Form 1040-X Amended US.

You still have the option to. Stamp duty is a tax on legal documents in Malaysia. Tax relief lowers your deductible annual income to reduce the amount of taxes which youll have to pay.

Employer is not required to send notification using CP22 to the IRBM if. SQL Payroll Software ready with all HR management eLeave PCB tax calculator specific contribution assignment and automatic overtime calculation. Some examples of documents where stamp duties are applicable include your Tenancy Agreement Instrument of Transfer and Loan Agreements.

Verify the PCB amount with an LHDN-approved HR tool. The new employee is not subject to income tax. Official PCB Calculator from LHDN Hasil.

Unabsorbed losses and capital allowances cannot be taken forward.

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Malaysia Personal Income Tax Guide 2021 Ya 2020

Brownies 1 Savory Snacks Tart Baking Microwave Recipes

Download And Guide For Lhdn Tp3 Form For New Join Staff In Pcb Calculation Plus Tp1 And Tp2 Form Youtube

Should Influencers Gig Workers And Those In The Digital Economy Pay Income Tax To Lhdn Iproperty Com My

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

How To Do Pcb Calculator Through Payroll System Malaysia

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Cukai Pendapatan How To File Income Tax In Malaysia

Details Of 2 Agent Commission Withholding Tax L Co

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

How To Calculate Monthly Pcb Income Tax In Malaysia Mkyong Com

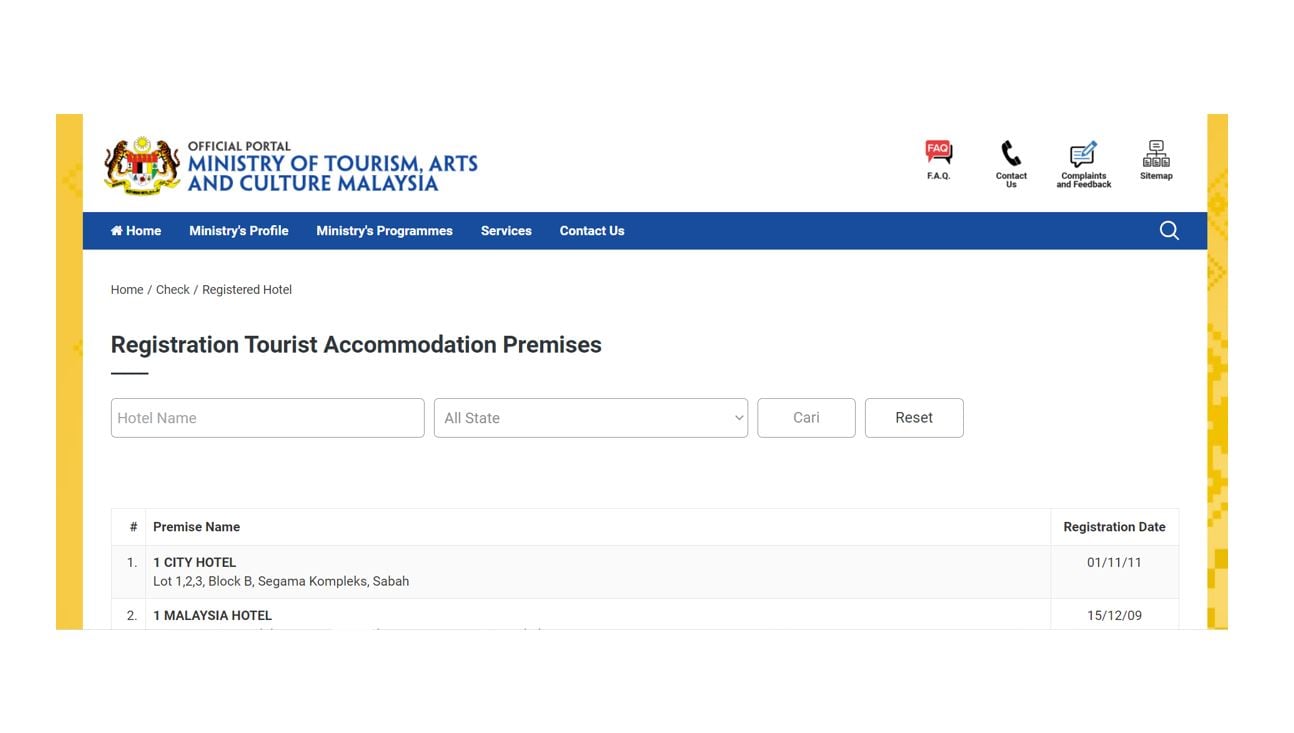

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

Simple Pcb Calculator Malaysia By Appnextdoor Labs

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator